Accounting 101: Debit and Credits

- Contributor

- Chad Branson

May 15, 2023

As a successful business owner, you might think you understand the concept of debits and credits. But … do you really?

On the surface, the definition seems self-explanatory: Debits and credits indicate the flow of value into and out of a business. They’re like two sides of a coin; every credit must have a corresponding debit for the same dollar amount, and vice versa.

But dig a little deeper, and you’re likely to discover some wrinkles that are hard to wrap your head around. For example, did you know that to increase an asset account, you record a debit, but to increase a revenue account, you record a credit? (See chart, below.)

After reading this article, you will understand the tricky concept of debits and credits — which is important because they are the building blocks of the double-entry system of accounting. As a small business owner, you will need to understand the language of accounting so you have a clear view of your business’s health. And that means you can make more accurate and better business decisions.

Forget What You Think You Know About Debits and Credits

Before we dig into the Accounting 101 concept for the day, we need to address the elephant in the room: banking debits and credits are different than accounting debits and credits.

If you have heard the terms “debit” and “credit” from working with your bank, you might think that all credits increase the value of your account and all debits decrease the value of your account. This isn’t true when looking at your own accounting records. To understand why banks use this terminology, you need to look at it from your bank’s perspective.

When you deposit money into your checking account, which is a debit to you because your asset increases, it is a credit to the bank because it is not their money. It is your money, and the bank owes it back to you. So on their books, it is a liability. Since an increase in a liability account is a credit, your debit (asset) is the bank’s credit (liability).

The differences between debits and credits in banking and accounting can trip many people up, so we encourage you to temporarily suspend what you know about debits and credits from a bank’s perspective and remember this:

- Debits, which are recorded on the left side of a journal entry, increase the balance of an asset or expense account and decrease the balance of a liability, equity, or revenue

- Credits, which are recorded on the right side of a journal entry, increase the balance of a liability, equity, or revenue account and decrease the balance of an asset or expense

T-Accounts

There is another concept that may be helpful to grasp if you want to fully understand debits and credits. Every account in the general ledger is represented by a two-column chart called a T-account.

When you record a debit to one T-account, you must record an equal but opposite credit to one or more T-accounts. All debits will be placed on the left side of a T-account, and all credits will be placed on the right side. At the end of the day, the sum of the debits from all T-accounts should total to the sum of the credits.

Remember: Debits increase the value for asset and expense categories, but for other accounts, the opposite is true. Let’s look at a few examples of how to use T-accounts.

Example 1:

You use cash to purchase a piece of equipment worth $10,000. When you record the entry in your general ledger, this is what your T-accounts should look like:

To decrease your cash account (which is an asset), you will record a credit of $10,000. To increase your equipment account (which is also an asset), you will record a debit of $10,000. At the end of the day, debits and credits total to the same amount.

Example 2:

The next day, you purchase another piece of equipment for $8,000, but because you don’t have enough cash to pay for it outright, you only put $1,000 down in cash and use debt to fund the rest. Here are what your T-accounts should look like after that equipment purchase:

As you can see, you must record a credit to increase your debt account.

In the end, all the cumulative debits sum to the same number as all the cumulative credits.

Example 3:

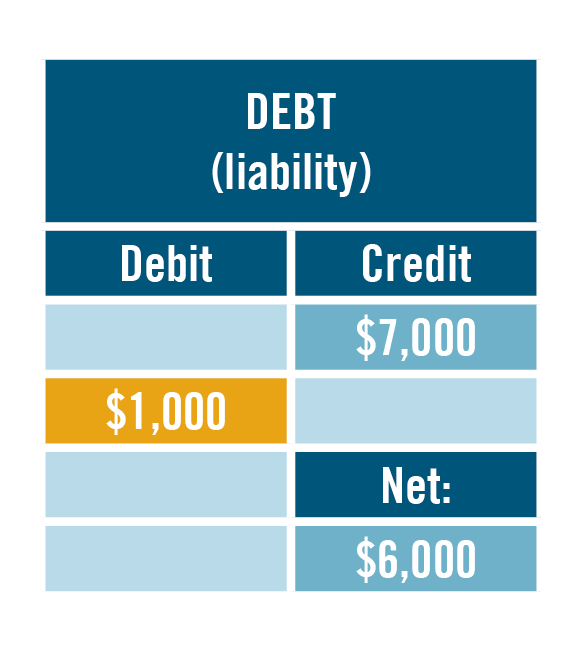

At the end of the month, it’s time for you to make a payment on your $7,000 loan. Let’s assume the debt payment is for $1,025, with $1,000 going toward the principal and $25 in interest. Here are what your T-accounts should look like after you make that payment.

Cumulatively, all debits sum to the same number as the credits.

T-Accounts Today: Where Are They?

Today’s accounting software doesn’t display your general ledger in T-account form. All T-account information is kept behind the scenes. The software will record all your debits and credits to the correct accounts without any action on your part. As long as you follow the software’s journal entry posting guidelines, your debits and credits should always equal in the end. Typically, accounting software programs will give a warning if you try to post an entry that is out of balance.

Even though your accounting software won’t show T-accounts, it can be helpful to think of debits and credits in this manner because it helps you see how each entry adds to or subtracts from the previous entry. In the third example from above, you can see that after you make your debt payment, the remaining balance in your debt account is $6,000.

Why Are Debits and Credits So Confusing?

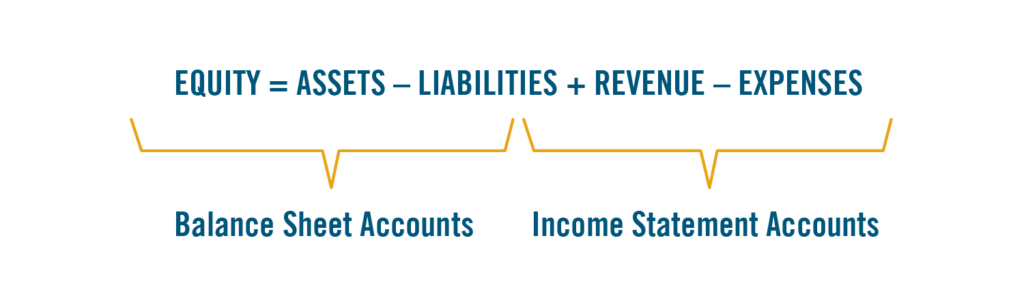

The double-entry accounting system is established for a good reason: so that the following accounting equation is true:

No matter what action you take or what entry you book, this accounting equation must be true. If your accounting software gives you an alert or warning that one of your entries is out of balance, you can step back and think about T-accounts again. Sometimes walking through an entry using T-accounts can help you understand exactly why you’re making the entries that you are trying to post.

If debits and credits are still tripping you up, that’s OK. This isn’t a simple concept to understand, especially if you have a large chart of accounts. Knowing whether an account increases with a debit or increases with a credit is something you’ll learn over time. If you ever have any questions about a complex journal entry, or if for some reason your debits and credits don’t balance, reach out to your CRI CPA. We’ll walk you through the entry and make sure you fully understand it.