From Red Carpets to Tax Returns: The Versatile Roles of Accounting Firms

- Contributor

- Kendra LaFleur

Feb 7, 2024

When the term “accounting firm” is mentioned, many immediately conjure images of tax returns, number crunching, and financial audits. Indeed, these tasks form the bread and butter of an accountant’s year-round responsibilities. Yet, the realm of accounting is far more varied and intriguing than one might expect. From strategizing on estate planning to advising startups, optimizing business operations, and even navigating the complex waters of international trade and finance, accounting firms are integral to individuals’ and businesses’ financial health and strategic planning. But, nestled among these expected duties lies a role less known to the public: the critical part accounting firms play behind the scenes of the high-stakes, glamorous award shows that captivate us each awards season.

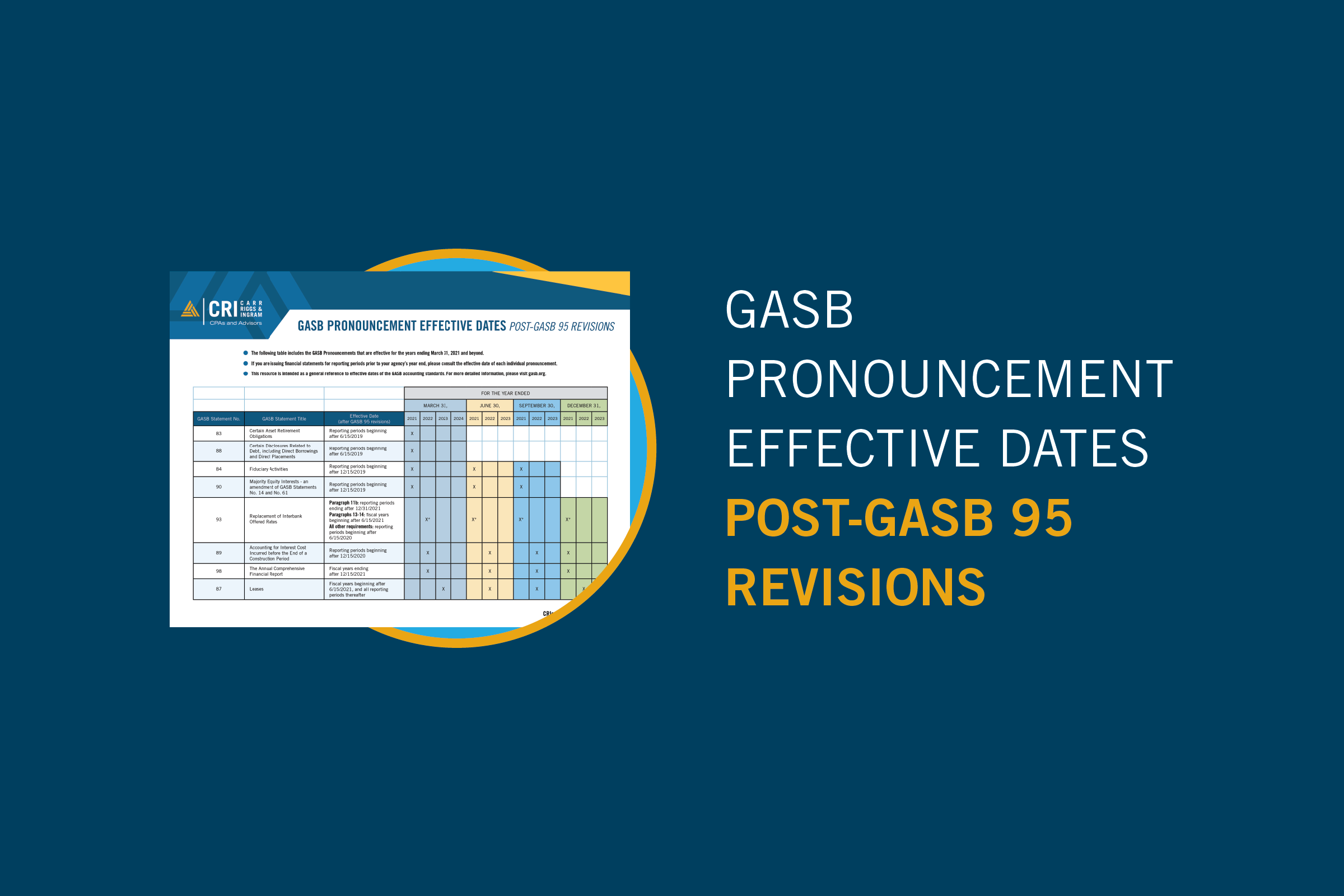

Award shows have relied on accounting firms for decades to safeguard the results, creating an air-tight environment of secrecy around the winners until the big reveal. This tradition was established in 1941 as a safeguard against the premature disclosure of winners that occurred during the 1940 awards season. Since then, major accounting firms have overseen this crucial process for awards shows, safeguarding the winners’ names until the final reveal. Beyond this particular high-profile task, these firms also oversee the financial audits and tax matters of the organizations behind the ceremonies, seamlessly blending the allure of show business with the bedrock principles of accounting.

Precision in Tabulation

As with all matters pertaining to accounting, accuracy is non-negotiable. In the context of award shows, with potentially thousands of votes to count and numerous categories to manage, the precision of an accountant’s work ensures that every vote is counted correctly. This meticulous attention to detail is just as critical when handling everyday clients’ financial needs.

Whether calculating taxes, managing investments, or preparing financial statements, meticulous attention to detail is paramount to safeguard the integrity and accuracy of each client’s financial records. A single miscalculation can lead to significant consequences, ranging from financial setbacks to legal compliance issues. Just as a misplaced envelope can overshadow an award ceremony, even a minor accounting error can have substantial repercussions for an individual or a business, leading to financial discrepancies, legal complications, and a loss of credibility.

The Essence of Trust in Accounting

Accounting firms stand as pillars of impartiality and professionalism, not only during the glitz of award shows, but also in their routine client interactions. Their oversight of award voting processes exemplifies their steadfast dedication to impartiality and professionalism, reflecting the deep trust and respect they maintain in all client interactions. From protecting confidential information at award ceremonies to diligently managing clients’ financial matters, accounting firms consistently prove that trust is the foundation of their services.

As you consider the opportunities and challenges in your own life where such precision and integrity could have the most significant impact, remember that the same meticulous care given to safeguarding the results of an awards show can be directed toward securing your financial well-being. Should the need arise for expert financial guidance, know that your CRI advisor stands ready to bring this same level of dedication and excellence to help navigate and enhance your financial narrative.