Lease Term vs. Maximum Possible Term

- Contributor

- Dean Michael Mead

Some governments need clarification due to the similarities between two aspects of Governmental Accounting Standards Board (GASB) Statement No. 87, Leases: maximum possible term and lease term. As such, it’s important to identify the differences between those two key components of the standards.

Maximum Possible Term: Is a Lease a “Short-term Lease”?

One of the first questions you must ask when applying Statement 87 to a lease is whether the lease is a short-term lease. That is because the general recognition and measurement model applies only to leases that are not short-term. Rather than recognizing an intangible right-to-use lease asset and a lease liability as a lessee (or a lease receivable and a deferred inflow of resources for a lessor), the payments under short-term leases are accounted for as expenses (revenues) of the period. The short-term lease accounting is less burdensome than the general model.

A short-term lease is defined as “a lease that, at the commencement of the lease term, has a maximum possible term under the lease contract of 12 months (or less), including any options to extend, regardless of their probability of being exercised.” Determining a lease’s maximum possible term is solely related to this purpose—it has no other function in the standards.

Lease Term: How Long Does a Lease Run?

For leases that are not short-term, a lessee measures its lease liability (and a lessor measures its lease receivable) in part by discounting future payments over the course of the lease term to their present value. An essential step in that process is determining the lease term—the period over which those payments will be made.

Why Are the Two Concepts Confused?

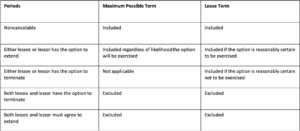

Apart from having similar names, many of the building blocks of the maximum possible term and lease term are the same:

Both the maximum possible term and the lease term include periods (years, months, days) during which neither the lessee nor the lessor can end the lease—called noncancelable periods. Both exclude periods containing “two-way” options—when both parties can end the lease without the other’s permission or when both parties must agree to extend the lease.

Maximum possible term and lease term differ regarding the circumstances under which they include periods with “one-way” options—either the lessor or the lessee has the option to extend or terminate. The lease term includes periods with one-way options to extend if it is reasonably certain that the party will exercise the option. It also includes periods with one-way options to terminate if it is reasonably certain that the party will not exercise the option.

On the other hand, the maximum possible term includes all periods with one-way options “regardless of their probability of being exercised.” The primary source of confusion with this aspect of Statement 87 is the mistaken view that the evaluation of “reasonably certain” is relevant to determining the maximum possible term; it is not.

Examples

A few simple examples illustrate the difference between the maximum possible term and the lease term.

Example 1: A government enters into a contract with a 6-month noncancelable period and an option to extend a further 12 months. It is reasonably certain that the government will exercise the option to extend.

This is not a short-term lease because the maximum possible term is 18 months—the 6-month noncancelable period plus the 12-month extension. The lease term also is 18 months—the 6-month noncancelable period plus the 12-month extension because it is reasonably certain to be exercised.

Example 2: A government enters into a contract with a 6-month noncancelable period and an option to extend a further 12 months. It is not reasonably certain that the government will exercise the option to extend.

This is not a short-term lease because the maximum possible term is 18 months—the 6-month noncancelable period plus the 12-month extension. The lease term, however, is just the 6-month noncancelable period; the 12-month extension is excluded because it is not reasonably certain to be exercised.

Example 3: A government enters into a contract with a 6-month noncancelable period; both the government and the other party have the option to extend a further 12 months.

This is a short-term lease because the maximum possible term is just the 6-month noncancelable period; because both parties have the option to extend, the additional 12 months are excluded. Therefore, the lease term is not evaluated because it is relevant only to leases that are not short-term.

Assistance With the Leases Standards

If you need help implementing the leases standards, don’t hesitate to contact CRI. Our user-friendly software, CentraLease, simplifies implementation and ongoing compliance, creating a hassle-free lease compliance experience.

Subscribe to our e-communications to receive the latest accounting and advisory news and updates impacting you and your business.