GASB Statement 94: Decoding P3s, SCAs, and APAs

- Contributor

- Dean Michael Mead

Governmental Accounting Standards Board (GASB) Statement No. 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements, is one of a trio of pronouncements that apply a common accounting and financial reporting model to transactions that involve acquiring the right to use another entity’s capital assets. (The other two are Statement No. 87, Leases, and Statement No. 96, Subscription-Based Information Technology Arrangements.) Here are the answers to five basic questions about Statement 94.

Statement 87 covers most transactions in which a government acts as a lessee or lessor. However, it excludes certain transactions with unique characteristics that require additional accounting guidance beyond the basic lease standards. Service concession arrangements (SCAs)—a type of public-private or public-public partnership (P3)—are one kind of those transactions. Stakeholders asked the GASB to review the existing guidance for SCAs (Statement No. 60, Accounting and Financial Reporting for Service Concession Arrangements), develop guidance for P3s as a whole, and address a developing form of transaction that is similar to SCAs, called availability payment arrangements (APAs).

In a P3, a government (the transferor) contracts with an operator to provide public services for a length of time using an existing capital asset of the government (such as a building or highway that the operator improves) or a new capital asset that the operator buys or builds, in return for compensation at or near market rates (i.e., an exchange or exchange-like transaction). An SCA is a type of P3 with the unique features that fees from third parties compensate the operator (typically the recipients of the service provided using the capital asset, such as drivers on a toll road), and the government can dictate the services the operator provides, to whom those services are provided, and the amount the operator can charge.

In an APA, the operator provides some combination of designing, building, financing, maintaining, or operating a capital asset. However, instead of being compensated by fees paid by third parties, the government pays the operator based solely on the asset’s availability to provide service.

An operator may be another state or local government (hence the inclusion of public-public partnerships in the Statement’s name) or a nongovernmental entity.

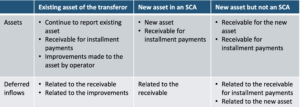

P3s, including SCAs, are accounted for using the same basic approach as for leases under Statement 87, with transferors in the lessor role and operators in the lessee role. The specific requirements depend upon (1) whether the P3 involves an improved existing asset or a new asset and (2) whether the P3 is an SCA. A transferor initially reports a P3 as follows:

In subsequent periods, the transferor reports revenue related to amortizing (1) the discount on the receivable for installment payments and (2) the deferred inflow of resources.

A governmental operator initially reports a P3 as follows:

In subsequent periods, the operator reports expenses related to the amortization of:

Accounting for an APA depends on what the operator is required to do—activities related to the capital asset, providing services, or operating or maintaining the asset. A component of an APA related to designing, constructing, or financing a capital asset should be accounted for as a financed purchase of an asset by the government. The other activities should be accounted for as an expense, like an ordinary service contract.

4. When should Statement 94 be implemented?

Statement 94 is effective for fiscal years ending June 30, 2023, and all reporting periods thereafter (September 30, 2023; December 31, 2023; March 31, 2024). As was done for leases, P3s should initially be recognized and measured using the facts and circumstances as of the beginning of the year of implementation (i.e., July 1 or October 1, 2022; January 1 or April 1, 2023).

5. How do I figure out whether Statement 94 applies to my government?

Start by reading Statement 94. Then reach out to CRI. We’re ready to help you determine whether you have any P3s, SCA, or APAs and, if so, how to accurately apply Statement 94 to them. You can learn more by downloading the resource GASB Pronouncement 94.

Subscribe to our e-communications to receive the latest accounting and advisory news and updates impacting you and your business.