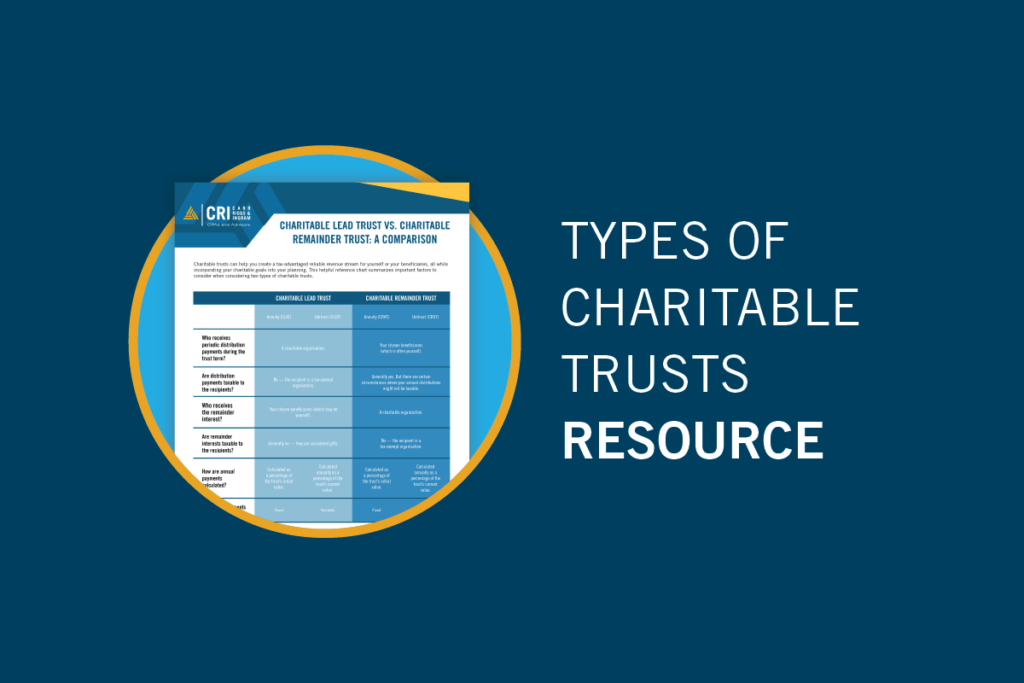

Charitable Lead Trust vs. Charitable Remainder Trust: A Comparison

Mar 4, 2022

Charitable trusts are often synonymous with estate planning because they provide you — the donor — with a wide range of benefits. Charitable trusts can help you reduce income taxes, reduce your estate tax, and protect your assets. Learn about two types of charitable trusts — charitable lead trusts and charitable remainder trusts — can play important roles in your estate plan.