Understanding Your Accountant’s Language

Sep 21, 2022

If the terminology your accountant uses sounds like a foreign language, don’t worry. Understanding your accountant is simpler than you may think. When they mention your P&L or the DOR or leveraged investments, they are talking about concepts you’re already familiar with. With time, these acronyms and terms can easily become second nature to you, too, so let’s review some of the most common.

P&L

The P&L — or profit and loss statement — is another term for income statement. This is the financial statement that summarizes your revenues and expenses over a specified time period (e.g., month, quarter, year).

Example: “The P&L shows we exceeded our operating budget for the quarter but are on track to meet our annual sales goals.”

Gross vs. Net

These terms are most often used when discussing income, but they can describe anything that can be counted. Gross means the total before any reductions, and net means the total after all reductions have been accounted for.

Example: “Gross revenues are looking good this month, but net of product returns our revenues are weaker than we’d like.”

Accruals

Accruals are items of income or expense that accumulate over time. Insurance expense is often accrued because, although you pay your premiums only twice per year, you reap the benefits of that protection equally throughout the year. To accrue insurance, you would record one-sixth of the expense each month and true up any differences between your accrual and actual when you pay your biannual bill.

Example: “Even though the client won’t send us payment until next quarter, we began accruing the revenue when we began construction.”

Leveraged

When accountants say an asset has been leveraged, they mean the company has taken out a loan to pay for it. Leveraging investments is not intrinsically good or bad, but most companies only leverage asset purchases when their investment-related revenues will outweigh the cost of borrowing (i.e. when it’s cost beneficial).

Example: “The price is a bit high. We’ll need to leverage our line of credit to make an attractive offer.”

GAAP

Accounting principles generally accepted in the United States, or U.S. GAAP, is an authoritative set of accounting standards set by the Financial Accounting Standards Board (FASB). In general, only publicly traded companies are required to prepare their financial statements using GAAP, but private companies generally choose to follow GAAP to allow for comparisons to competitors or the marketplace or to appease their lenders.

Example: “We don’t follow GAAP right now, but our accountant is helping us conform since we expect to issue an IPO in five years.”

Capital Account

The term “capital account” is often used when discussing an individual’s equity investment in a business. The capital account for an S corporation shareholder, for instance, will initially be the same as the price they paid for their stock shares and will be adjusted for their portion of the business’s net income each year. But capital accounts can be adjusted for other reasons, such as assuming liabilities, taking out a shareholder loan, infusing additional capital, or taking distributions.

Example: “When I took out a shareholder loan last year, my capital account took a dip, so my distribution may not be tax-free this year.”

Disclosure

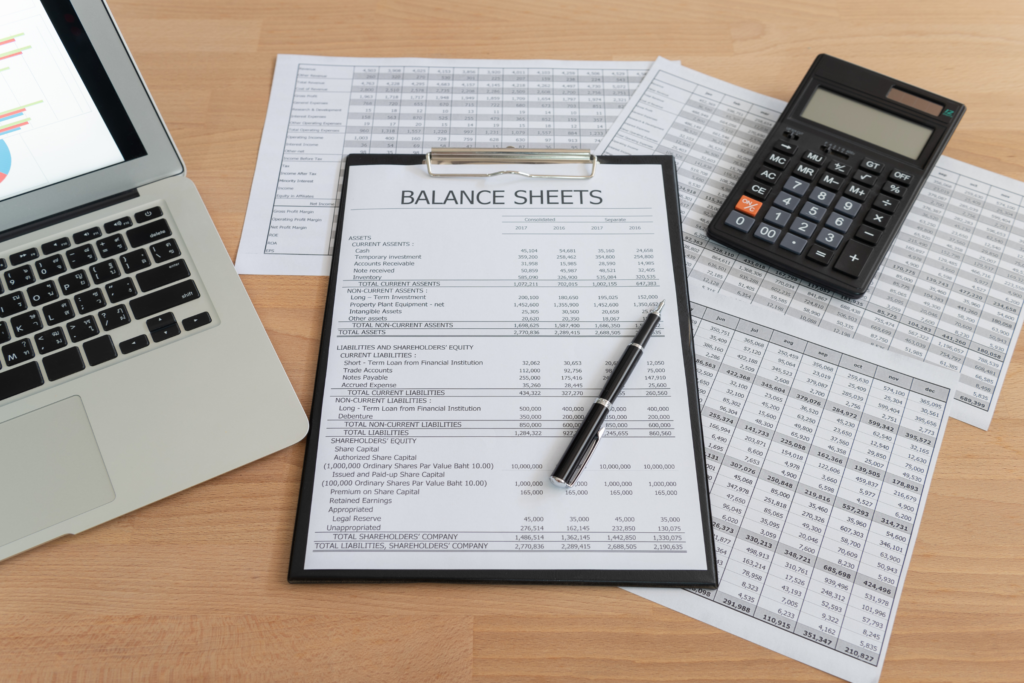

Disclosures refer to additional information that is included with and provides a more detailed description regarding the company’s financial statements. In general, entities use their disclosures to highlight key details and to provide clarity about the numbers shown on the face of the financials. Entities following GAAP have specific requirements. These disclosures are often in the form of a narrative, explaining figures on the balance sheet, income statement, statement of cash flows and statement of shareholders’ equity, but many disclosures include figures or graphs.

Example: “The new revenue recognition disclosures may take time to perfect, so let’s get started on those as soon as possible.”

DOR

This acronym stands for Department of Revenue. Other state and federal agencies are abbreviated in a similar way, including the DOC (Department of Commerce) and DOL (Department of Labor).

Example: “We contacted the DOR on your behalf and found out why you received that notice.”

POA

Powers of attorney (POAs) are state-specific documents that authorize a third party to act on behalf of another. The POAs that business owners grant to their accountants should always be limited to certain or specific activities, like discussing tax matters with the DOR or filing tax forms on their behalf.

Example: “Once we get that POA signed, our accountant can call the Secretary of State’s office to understand how the tax ruling will affect the tax return.”

Apportionment

In accounting, apportionment is often used to separate revenues and expenses into different groups. State tax apportionment, which is one of the most common uses of the term, is when the company’s net income is divvyed up — or apportioned to — each of the states in which they operate. Apportionment can be based on any factor, but for state taxes it is often calculated using a combination of sales, payroll, and property numbers.

Example: “Since we lost our North Carolina distribution channel this year, I expect our North Carolina apportionment factor to go down and our Georgia apportionment factor to go up.”

As you can see, the language of accountants is the language of business with a slight twist on dialect. When you have a good grasp of these common accounting terms, you and your accountants can more easily discuss your company’s health both on and off the balance sheet. Need more insight into how to get the most out of your conversations with your accountants? Read our how-to guide on communicating with your CPA. Ready for that chat? Reach out to your local CRI professional to schedule that meeting.