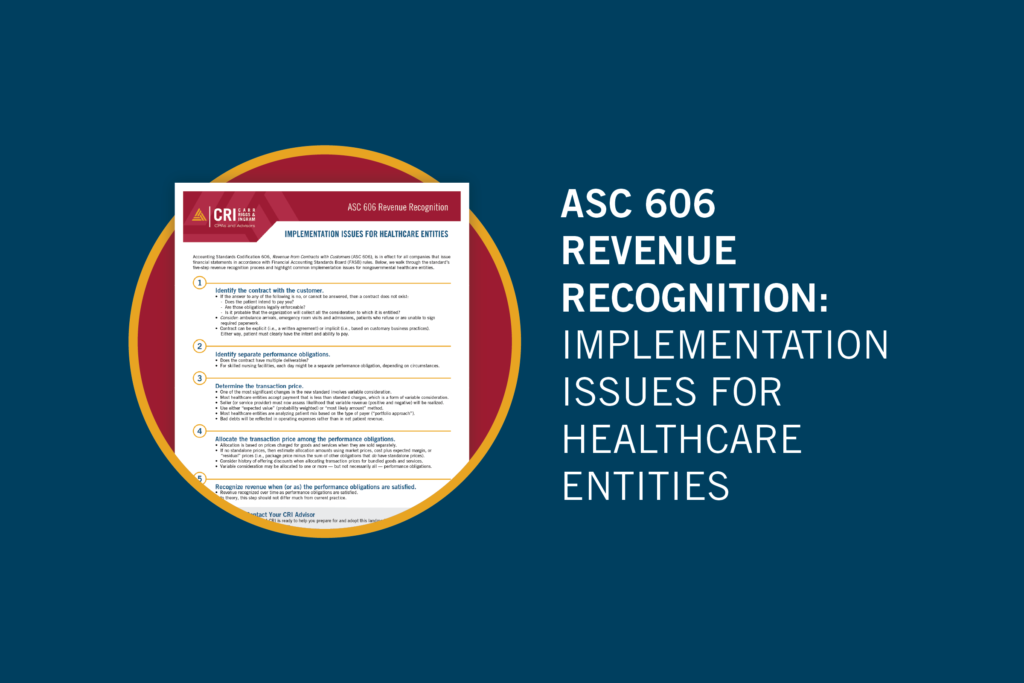

Even amid significant uncertainty, financial reporting must go on. One of the most pervasive accounting standard changes in recent history, Accounting Standards Codification 606, Revenue from Contracts with Customers (ASC 606), is now in effect for all companies that issue financial statements in accordance with Financial Accounting Standards Board (FASB) rules. (The Governmental Accounting Standards Board is in the midst of its own revenue and expense recognition project, so state- and county-owned healthcare facilities can’t afford to sit back and watch either.)

At a high level, the principle behind the new revenue recognition standard is simple: Recognize revenue from contracts when you meet the explicit or implicit performance obligations. But for healthcare organizations, application of that principle to notoriously complex revenue streams is not nearly as straightforward as it may seem.

For this reason, the American Institute of CPAs convened an industry task force to identify industry-specific revenue recognition implementation. Below, we walk through the new standard’s five-step revenue recognition process and highlight the most common implementation issues for nongovernmental healthcare entities.

1. Identify the contract with the customer.

While a contract can be either explicit (i.e., a written agreement) or implicit (i.e., based on customary business practices), the patient must clearly have the intent and ability to pay. To determine whether a contract exists, consider the following questions:

- Is the patient committed to perform his or her obligations? (In other words, does the patient intend to pay you for your services, and are those obligations legally enforceable?)

- Is it probable that the organization will collect all the consideration to which it is entitled?

If the answer to any of these questions is no, or if it is impossible to answer definitively, then a contract does not exist and revenue cannot yet be recognized. Keep in mind that you can rely on prior history with the patient to determine whether a contract exists. Some situations in which the determination of a legally enforceable contract can be tricky include ambulance arrivals, emergency room visits and admissions, and patients who refuse or are unable to sign required paperwork.

2. Identify the separate performance obligations.

The next step requires the organization to identify each “performance obligation” — an explicit or implicit promise to transfer a good or service to a customer. (These obligations must be considered in the contract, and they have implications that affect when and how much of the revenue allocated in step 4 will be recognized in step 5.)

One important point to consider is that healthcare services are often “bundled.” For example, the total bill for a hospital inpatient stay typically includes many different components, such as room and board, lab services, supplies, etc. Each of these components may or may not be considered a separate performance obligation, depending on the circumstances. Long-term care organizations have a number of other unique circumstances to consider. For skilled nursing facilities, for example, each day might be considered a separate performance obligation (again, depending on the circumstances).

3. Determine the transaction price.

The transaction price is the amount a customer promises to pay for goods or services — excluding third-party collections — and is affected by both the nature and timing of consideration to be received. In terms of the previous two revenue recognition steps, the transaction price is the amount allocated to performance obligations identified in a contract, and thus the amount of revenue recognized as those obligations are satisfied.

For healthcare entities, one of the most significant changes in the revenue recognition standard involves variable consideration. Acceptance of payment that is less than standard charges — which occurs in most healthcare contracts — qualifies as variable consideration. For the most part, previous accounting principles required that variable revenue amounts be recognized only when the circumstances making them variable were resolved. The standard now requires the seller (or service provider) to assess the likelihood that variable revenue (both positive and negative) will ultimately be realized.

All relevant information must be utilized in estimating variable consideration — using either the “expected value” (probability weighted) or “most likely amount” method. Most healthcare entities appear to be analyzing their patient mix based on the type of payer (i.e., contracts with similar characteristics). This is also known as the “portfolio approach.” (Expect more guidance from the FASB and SEC on this key step in the years to come.)

The difference between the amount an entity can recognize (most likely to receive in cash) and the standard amount charged is now called a “price concession.” Going forward, net patient revenue should closely match the estimated future cash flows from services provided at the time they are provided. Expect bad debts to all but disappear, except in cases where the patient or payer has a true inability to pay (i.e., credit issues). These bad debts will be reflected in operating expenses rather than in net patient revenue.

For organizations that file cost reports or otherwise retroactively settle claims with third-party payers, keep in mind that revenue can only be recognized to the extent that it is probable there will not be a significant reversal. Therefore, true-ups should not be significant going forward. If they are significant, it is likely indicative of a poor estimation process.

4. Allocate the transaction price among the performance obligations.

In this step, the transaction price determined in step 3 is allocated among the performance obligations identified in step 2. Allocation is based on the prices charged for goods and services when they are sold separately (i.e., “standalone” prices). If performance obligations are “packaged” and do not have standalone prices, then allocation amounts should be estimated using market prices, cost plus expected margin, or “residual” prices (i.e., package price minus the sum of other obligations that do have standalone prices). Companies should consider their histories of offering discounts when allocating transaction prices for bundled goods and services. Variable consideration may be allocated to one or more — but not necessarily all — performance obligations.

5. Recognize revenue when (or as) the performance obligations are satisfied.

In the fifth revenue recognition step, sellers (or service providers) recognize revenue when they satisfy performance obligations to reflect the actual transfer of control over assets or services sold to customers (or patients). The amounts recognized are the transaction prices that were allocated to performance obligations in step 4, and the revenue will be recognized over time as the performance obligations are satisfied. In theory, this step should not differ much from current practice.

Recognizing and recording revenue is not a simple matter for any organization, and healthcare organizations have some unique complicating factors. Confusion is likely among your board, ownership, and governance functions, so be sure to maintain steady communication throughout the transition, and reach out to your CRI advisor with questions.

Relevant insights

Join Our Conversation

Subscribe to our e-communications to receive the latest accounting and advisory news and updates impacting you and your business.